Decades-old retailers with valuation in the billions are quaking in their boots, afraid of one name above all others: Amazon. The Seattle-based titan of eCommerce looms over the entire retail economy and is expanding to more and more verticals with each passing quarter.

It’s only a matter of time until incumbents in the beauty industry find themselves putting out wildfires with a thimble of water. Before it’s too late, beauty retailers must implement retail analytics and smart eCommerce practices and evaluate factors such as minimum advertised pricing, product positioning, and assortment optimization processes if they hope to stand a chance.

Bottom of the Barrel

Whenever you check out of an online store and purchase the items in your cart, you may end up paying less than you thought, less than the price that was advertised. These savings come from an industry-wide principle known as minimum advertised pricing, or MAP.

MAP is an agreement between retailers and manufacturers that retailers won’t broadcast or post the price of a product below a certain threshold to ensure the manufacturer receives its desired profit margins and to protect its brand from maligned perceptions. This doesn’t determine the final price customers pay in the end, but it does guide purchasing behaviors and relations between retailers and manufacturers.

Beauty retailers will find themselves constricted by MAP and brand compliance with manufacturers when going head-to-head with Amazon, which isn’t bound by such agreements and frequently defies manufacturer’s wishes as it pushes prices to the bottom.

In order to keep a healthy sales pace, beauty retailers need to employ analytics software and processes akin to Amazon’s, so it can scan Amazon and other competitors’ sites for prices and make them competitive, either as advertised or sold.

No One Really Wins Price Wars

When Amazon enters a new market, it plays to win. It algorithmically drops prices to the levels lower than everyone else’s, focusing less on profitability and more on becoming the destination for all shopping.

Affected retailers feel they can respond by lowering their prices to compete and maintain sales, which undercuts their profit margins and enrages their manufacturing partners. Unfortunately, Amazon’s prices are governed by algorithms that perpetually push its prices below other competitors’, turning it into a race to the bottom. And when a market reaches the bottom, victory goes to whoever has the most scale, which will forever more be Amazon.

Look at the consumer packaged goods (CPG) and electronics markets for a history lesson that will absolutely repeat itself.

Big brands owned by huge conglomerates like Colgate-Palmolive, Kimberly-Clark, Nestlé, and Procter & Gamble are getting squeezed in the CPG price wars. Consumers are shifting their habits and opt for cheaper goods. Brand loyalty is quickly becoming a thing of the past, as these aging giants are discovering.

The dust may have settled in the electronics market, but its lessons still have immense value today. Amazon started selling electronics in 1999, focusing on items like remotes and headphones. This approach shattered electronics retailers’ margins, bankrupting Circuit City in 2008 and sending Best Buy on a years-long downward spiral.

Best Buy survives today purely because it scaled back operations and shifted its sales focus onto services, a much more expensive process than running an online marketplace. As well, Best Buy practically bent the knee to Amazon because it now sells Amazon’s Fire TVs.

So how has the beauty market lasted this long and what will it look like when Amazon comes knocking?

Beauty products are best tested in person, no doubt. Even augmented reality can’t simulate the texture of a new lipstick or the scent of a skin cream, which means brick-and-mortar remains an essential component to this industry.

Social media and community engagement have proven to be powerful drivers for sales growth for beauty brands and retailers alike. Sephora’s Beauty Insiders Community, which functions like an internal social network and rewards program, is sure to keep customer loyalty strong.

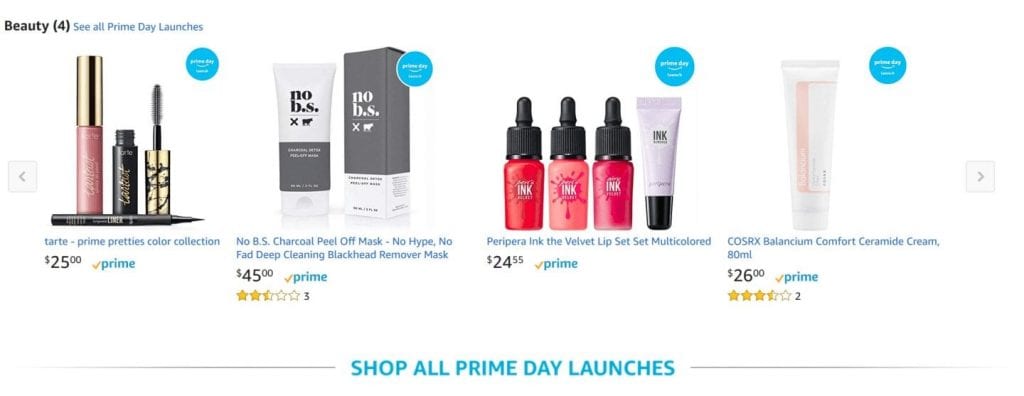

When Amazon starts building a beauty recommendations program like its personal stylist feature, that’ll be a huge signal fire for the beauty industry. Not much later, Amazon will start selling white-label products for much cheaper than industry incumbents can sustain.

Next from Amazon’s playbook will be the partnerships. Amazon will find some smaller beauty brands hungry for increased sales and offer a sweetheart deal they’d be stupid to refuse. As retailers begin to feel a chill in the air, Amazon will swoop in and partner with one to start stocking and recommending its white-label products, be it Sephora or Ulta or a handful of smaller retailers.

The sheer scale and opportunity Amazon offers will be too lucrative to resist, especially for the first movers.

Preventive Measures

So if that’s what the problem looks like, beginning, middle, and end, what can beauty retailers do to shore up their position?

First, they should keep employing similar innovations like Sephora’s Beauty Insiders program and leveraging social media. That’s a strong defensive moat and will certainly cost Amazon a lot of resources and time to replicate.

Next, beauty retailers need to start using some of Amazon’s tactics against it. Deploying onsite user analytics is the first step, but the technology necessary to compete will go far beyond abandoned cart reports. Amazon has tracked user behavior for over a decade and built a recommendations engine from all that data that feels personalized to each and every user.

Beauty retailers need to analyze user behaviour at scale and start running experiments with product positioning and assortment optimization. They need to answer questions like:

- What assortment of items on the homepage leads to more engagement and sales?

- If customers love Rihanna’s FENTY BEAUTY eyeliner, what products can be shown next to it in the catalog or be recommended once it’s in the cart?

- How do we optimize our offerings to promote the best performers while not losing the essentials?

Making the online shopping experience smooth and satisfying is how Amazon survived the dotcom bubble of the early aughts and prevailed to become one of the most powerful companies in the world. Assortment optimization and product positioning are two essential elements to smoothing out eCommerce – sometimes recommendations are so good that customers didn’t even know they wanted the second item until they saw it.

And finally, retailers need to adopt an intelligent dynamic pricing model governed by automated software. Amazon does it, scanning every competing site it can, ingesting product and pricing data, and altering its prices to levels optimized for making sales. The lowest price isn’t always the best price, so the repricing software needs to identify the best fit for the retailer. Don’t forget: Amazon can afford to drop prices as much as it wants.

Tactics like these can save the beauty industry from the slump plaguing the entire retail sector and help beauty companies grow on their own terms, not Amazon’s. To learn more about these technologies essential to the future, retailers should act fast and schedule a demo before Amazon swoops in yet again.