In the digital age, where the battleground for consumer attention is fiercer than ever, “search” has emerged as the cornerstone of eCommerce. Almost every shopper’s journey begins with a search, whether on a search engine or digital marketplace, underscoring the critical role of online visibility in shaping purchasing decisions. Further, with modern consumers’ attention spans waning, most shoppers tend to purchase products listed among the first few search results, rarely venturing beyond the first page. Thus, the race to secure a spot at the top of the first page of Search Engine Results Pages (SERPs) has become paramount.

Today, as brands and retailers navigate the complexities of balancing paid and organic search strategies to enhance their online product visibility, digital shelf optimization and analytics tools have become an integral part of a successful retail strategy. To bridge the gap in understanding online consumer behavior, Intelligence Node’s 2024 consumer survey report sheds light on the nuances of digital shoppers’ preferences and actions. This comprehensive study, drawn from responses from 1,000 US-based shoppers, delves into the intricacies of consumer expectations and behaviors in the digital marketplace. These insights are aimed at equipping brands for success in the highly competitive retail landscape, highlighting the indispensable role of product content and visibility.

To learn more, download the eBook today!

Decoding Product Visibility: The Initial Touchpoints for Product Discovery

Google Search has emerged as the leading platform for initiating product searches, with nearly 37% of consumers opting for this route. This marks a notable change from the previous year when Amazon led the race. Following closely in second place, Amazon remains a dominant force, with one out of every three shoppers starting their search on the marketplace. This reflects the platform’s continued influence on consumer shopping habits, despite the growing ease and popularity of search engines. Demographics play a significant role in shaping these trends. Younger age groups, specifically those aged 18-24, predominantly initiate product searches on Amazon. This demographic also uniquely prioritizes social media as a starting point for product searches, placing it third after Amazon and Google.

Interestingly, alternative marketplaces like Walmart and eBay capture a mere 4% of initial product searches. However, the Direct-to-Consumer (DTC) model has carved out its niche, with over 11% of consumers preferring to start their search directly on brand websites. This preference indicates a growing consumer desire for brand engagement and direct interaction.

Collectively, these trends reveal that 70% of shoppers prefer Google Search or Amazon for beginning their online product journeys. This consolidation of consumer preference highlights the critical role these platforms play in the digital retail ecosystem, guiding brands on where to focus their digital marketing and visibility efforts.

How Modern Consumers Filter Through Digital Search Results

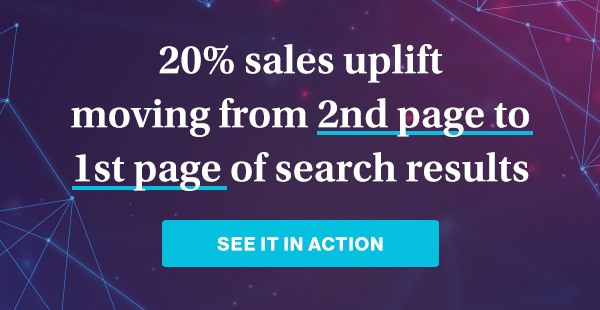

Nearly half of all those surveyed claim to limit their product exploration to just the first page of search results, highlighting the critical importance of top-page product visibility for online retailers. Within this group, a notable 19% of shoppers show a pronounced tendency to opt for products that appear within the top 5 search results.

Delving deeper, about 28% of consumers extend their product considerations to encompass the entirety of the first page. This suggests a more meticulous approach to product selection, albeit still confined to the initial page of results. Contrasting with this behavior, over half of the shoppers (53%) exhibit a more expansive browsing habit, venturing through the first two to three pages before finalizing their purchase. This behavior is particularly prevalent among those aged 25 and above, indicating a demographic tendency towards more thorough research and comparison.

Furthermore, it’s noteworthy that a third of shoppers within the 18 to 24 and 35 to 44 age brackets demonstrate a preference for selecting products from the top 5 search results. This statistic not only reflects the influence of search result ranking on consumer choice but also suggests that younger shoppers, in particular, may prioritize convenience and immediacy in their online shopping habits.

Shoppers’ Responses to Organic Versus Sponsored Product Listings

A clear majority, comprising 52% of shoppers, exhibit a pronounced preference for organic search results. This group is further segmented into 31.4% who prioritize organic listings over others and 20.7% who exclusively engage with organic results, steering clear of sponsored ones entirely. This trend highlights a general inclination towards the perceived credibility or relevance of organic search outcomes.

On the other end of the spectrum, a mere 6.5% of shoppers show a preference for paid search results. This minority stance showcases a trend of prevalent consumer trust in organic listings as more authentic or reliable.

Conversely, a substantial 41% of consumers claim to be neutral between organic and paid search results. This suggests that for a significant portion of the market, the decision to engage with a search result is influenced more by the immediate relevance or appeal of the listing than by its organic or sponsored status.

Demographic insights reveal that younger consumers, specifically those within the 18 to 24 and 35 to 44 age brackets, exhibit a strong preference for organic over paid search results, possibly reflecting a more discerning understanding of the differences between the two. Meanwhile, shoppers aged 44 and above tend to be indifferent between organic and paid listings, indicating that the perceived authenticity or credibility associated with organic search results may not significantly influence this group’s purchasing decisions.

The Role of Product Content in Online Shopping Decisions

In the digital marketplace, the presence and quality of product descriptions and images play a pivotal role in guiding consumer purchasing decisions. Over 57% of respondents have expressed that insufficient product descriptions and the absence of product images are significant factors that lead them to leave a product page in search of alternatives. This statistic highlights the critical importance of detailed product information and visual representation in retaining potential buyers’ interest and trust.

However, brand reputation emerges as a powerful factor that can mitigate the negative impact of these shortcomings. Customers often show a willingness to overlook the lack of detailed product descriptions and images when dealing with products from well-known and trusted brands.

Moreover, the assurance of a strong return policy serves as another influential factor that can encourage customers to proceed with a purchase, even in the face of inadequate product details or missing imagery. This insight points to the effectiveness of return policies in building consumer confidence and facilitating purchasing decisions, emphasizing the need for retailers to consider comprehensive return policies as part of their online sales strategy.

CONCLUSION

Navigating the complexities of the digital marketplace requires a deep understanding of consumer behavior and a strategic approach to enhancing your online product visibility and presence. With Intelligence Node’s advanced technology, empower your brand with tailored solutions designed to boost your product content, increase visibility, and improve your overall strategy on the digital shelf. Seize the opportunity to reclaim your competitive edge- book a demo with us today and learn how we can help your brand stand out and succeed in the competitive online retail environment.