The ongoing Russia-Ukraine war, supply chain issues, surging demand, rising production costs, and the disruption caused by COVID-19 have all contributed to the inflation that has hit the US market with full force. The retail sector is seeing a steady decline in consumer spending as prices across categories are rising since March this year. Inflation reached nearly 8.5% in March 2022 in the US, the highest it has been in 40 years. Investors’ loss of confidence in the US retail market was evident as some of the largest retailers experienced the biggest declines in their stock prices since the 1987 market crash. Add to this the impending recession and it paints a bleak picture for the retail sector.

But retailers are not ready to give up without a fight. They have navigated the unprecedented crisis posed by the pandemic by arming themselves with technology and digital tools less than two years ago and are ready to do the same to weather the inflation and get back on their feet.

Inflation Strikes in the Grocery Sector

While all retail sectors took a hit, consumers first noticed price inflation in daily essentials like gasoline and grocery and the dent it was making in their pockets. The increase in grocery prices was somewhat slower in April than the 1.5% gain in March. Still, it marked the fourth straight month where grocery prices increased by at least 1%. Dairy prices spiked in April by 2.5%, while fruits and vegetables saw modest price declines.

Prices for cereals and bakery products rose by over 1% last month and are up by more than 10% over the year before due to the limited grain and fertilizer exports from Ukraine and Russia affecting the global food supply.

Intelligence Node tracked 20+ food and grocery retailers including 2343 locations for Walmart and 69 locations for Kroger as well as Amazon & Instacart ‘online only’ businesses, in the last quarter, covering over 60% of the US grocery market. Here’s what we found:

As observed below, Intelligence Node’s data shows a similar inflationary trend as noticed in the last few months, corroborating the already known incline in the prices in the last few weeks.

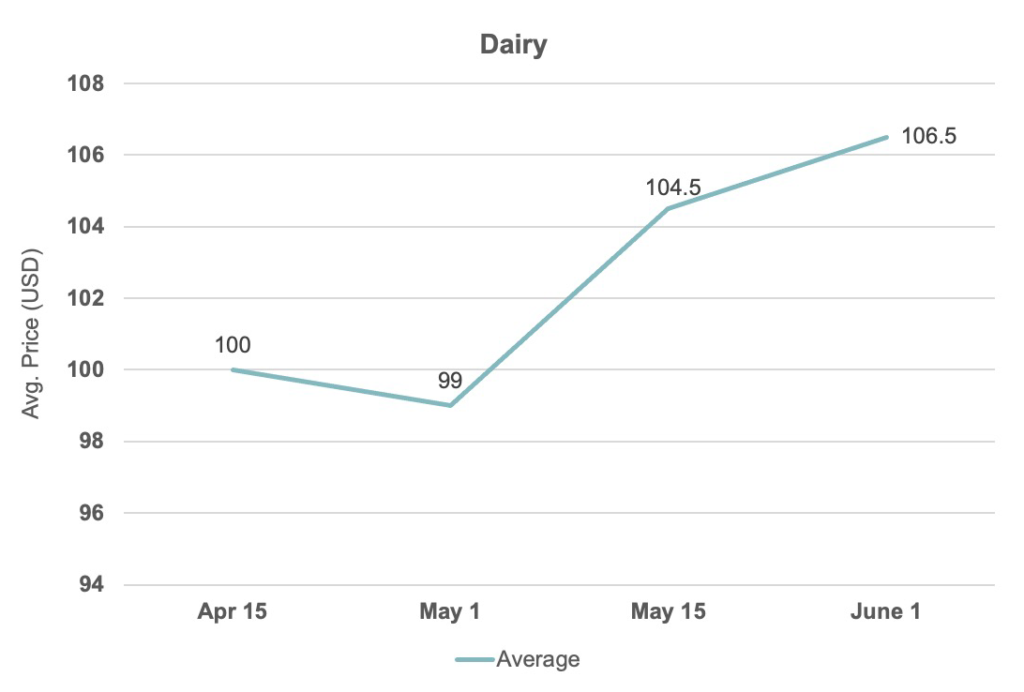

In the above graph, we can see that from April 15th to June 1st of this year, that grocery prices have been on the rise and have steadily increased. This price movement across grocery retailers warrants the economic inflation that is currently plaguing the US.

Drilling down further in the grocery sector, Intelligence Node’s data found a steady incline in the prices of dairy products as well across retail giants Amazon. Kroger, Walmart and others with prices of dairy spiking in May and June as compared to April, indicating the rising inflation in the US.

If this upward price trend continues, consumers are soon going to tighten their spending and be more economic with their shopping habits. Shopping on discretionary items like apparel and home decor is already taking a hit as inflation is making shoppers funnel more money into necessities like groceries and fuel. Brands and retailers should use the ongoing inflation as a springboard to evaluate, reimagine, and future-proof their businesses with the help of optimized processes, and a focus on consumer buying preferences. Although some may argue that technology is an investment and will add to the already high operations costs during inflation, over time the deflationary nature of technology will ensure that the more retailers invest in technology the lower the costs over time. Keeping this in mind, now’s the best time for retailers to invest in advanced retail technology.

Below, we discuss 7 ways for brands and retailers to counter the effects of inflation on their businesses and stay afloat even as the retail sector faces disruption, lower demand, reduced bottom lines, increased costs, and instability.

1. Enhance supply chain visibility and fulfillment strategies

Retailers can optimize their supply chain and distribution costs by rerouting shipments through lower-cost ocean lanes and ports, building strategically located fulfillment centers that lower last-mile costs and balance labor costs. Retailers can also explore third-party delivery logistics partners to reduce overheads and capital expenditure, improve processes by using their expertise and technology and find ways to streamline and bolster the delivery network. By using automated supply chain solutions, retailers can have end-to-end visibility into online and offline inventory, utilize excess in-store inventory to fulfill online orders, enhance omni channel presence, and improve the consumer experience.

2. Revisit assortment mix and category strategies

Recession and inflated prices are already affecting shoppers’ spending power and shopping preferences. Retailers need to take these factors into consideration when they revisit their assortment strategy and create categories and product mixes that sell. As consumers get more price-sensitive, their loyalty to a brand reduces proportionately. This behavior attracts them to less expensive private label products and cost-effective product bundling. Retailers should take this opportunity to test and promote private label goods while also having a healthy mix of high-demand branded goods to ensure adequate sales. Bundling the right products at attractive prices can be another strategy that leads to more sales per shopper without eating into product margins.

3. Leverage predictive analytics for accurate sourcing

During inflation, it becomes more crucial than ever to stock the right quantities of the right products. Excess inventory will lead to money and warehousing space locked in dead investments and understocked inventory will lose you business in an already tight economy. To ensure the right sourcing of products at the right time retailers need insight into consumer trends, shopper preferences, and historic data. This is a game of numbers and has to be backed up by accurate analytics to ensure optimal sourcing. According to the Wall Street Journal, joggers are piled up at Gap, Macy’s has overstocked on activewear, and Kohl’s is full of fleece. These retailers did not anticipate shoppers shifting their spending from casual clothes and home improvement items which were popular six months ago and are now stuck with excess inventory. These examples reiterate the importance of using predictive analytics to source the right products at the right time in the right quantities.

4. Channelize pricing solutions to improve margins

Inflation combined with the recession has a direct impact on consumer spending power. Shoppers try to save more for the rainy day and have to shell out more money for essentials as prices soar and make a a dent in shoppers’ pockets. This instability makes shoppers more price-sensitive, with a quest to find the best deals across platforms. As retailers battle it out to offer the most competitive prices to shoppers, a single wrong pricing move can have massive repercussions and affect margins and conversions. With stakes so high, pricing decisions need to be backed by accurate data and analytics. Retailers cannot rely on gut feeling or historical data alone but need data that delivers speed, accuracy, and insights from multiple first and third-party sources, checking the 3 Vs of eCommerce data (volume, velocity, and variety). Retail businesses need a smart, automated pricing solution that will track, compare, and optimize prices in line with competitors to get a market advantage. Intelligence Node’s AI pricing solution checks all these boxes and can be implemented within days and scale up or down as required, acting as a perfect ally to combat inflation.

Read More : 9 Reasons Why You Need an AI Pricing Tool Now!

5. Invest in the right marketing channels

The first instinct of a business owner or a marketer is to cut marketing costs as inflation hits. That’s where they go wrong. As inflation hits and consumer spending and product costs increase, marketing is one area that still needs to be working at its full potential with every penny to spare. Marketing can create demand where there isn’t any and pull shoppers to your store. Instead of reducing marketing spending or scrapping marketing campaigns, retailers need to revisit their marketing strategy and find ways to optimize processes, reshuffle budgets to prioritize marketing channels with maximum ROI and identify marketing areas that can generate more revenue for the company.

6. Explore new digital avenues for selling your products

To fight inflation and gear up for a channel-agnostic shopping experience, retailers need to be present online, offline, and across channels. While many retail businesses ramped up their eCommerce operations amidst COVID-19 and streamlined omnichannel operations by offering curbside pickup, BOPIS, and touchless delivery, the future of retail is far more technologically advanced, evolved, and diverse. Think the metaverse, the newest virtual playground for brands and retailers to dip their toes in. Many big brands like Nike, Gucci, Balenciaga, and Forever 21 have already rushed to invest in the metaverse and sell their products virtually through integrations, games, and stores. Web3 and the metaverse are already on the way to disrupt retail as we know it and businesses could use the backdrop of inflation to test these platforms and introduce new ways to sell their products.

7. Engage and convert consumers through loyalty programs

A robust loyalty program can go a long way in retaining current customers and attracting new ones, especially during a recession when price benefits exceed all other shopping preferences. By offering reward points, early access to sales, additional discounts on a specific amount of spending, preferential delivery, free delivery, and other enticing offers, retailers, and brands can ensure consistent sales across offline and online channels. Communicating offers to consumers proactively and being transparent with them will build brand loyalty and work as a strong pillar during inflationary periods.

Final Word: Harnessing Technology to Combat Inflation

The last two years have seen massive disruption in retail as the pandemic transformed the way consumers shopped and coaxed retailers to adopt new technologies and shift focus to digital. Retailers that pivoted quickly survived, many even thrived despite complications in the supply chain, closed economies, and reduced spending power. Today, once again retailers are at the crossroads of another disruption, this time caused by rapid inflation. Technology and innovation will once again come to the aid of retail businesses – from helping them plan and streamline inventory and sourcing, pricing and assortment, and omnichannel distribution to personalization, customer service, trend forecasting, and a lot more. The sooner brands and retailers embrace this idea and invest in the right technology, the more chances of them emerging from the inflation unscathed.